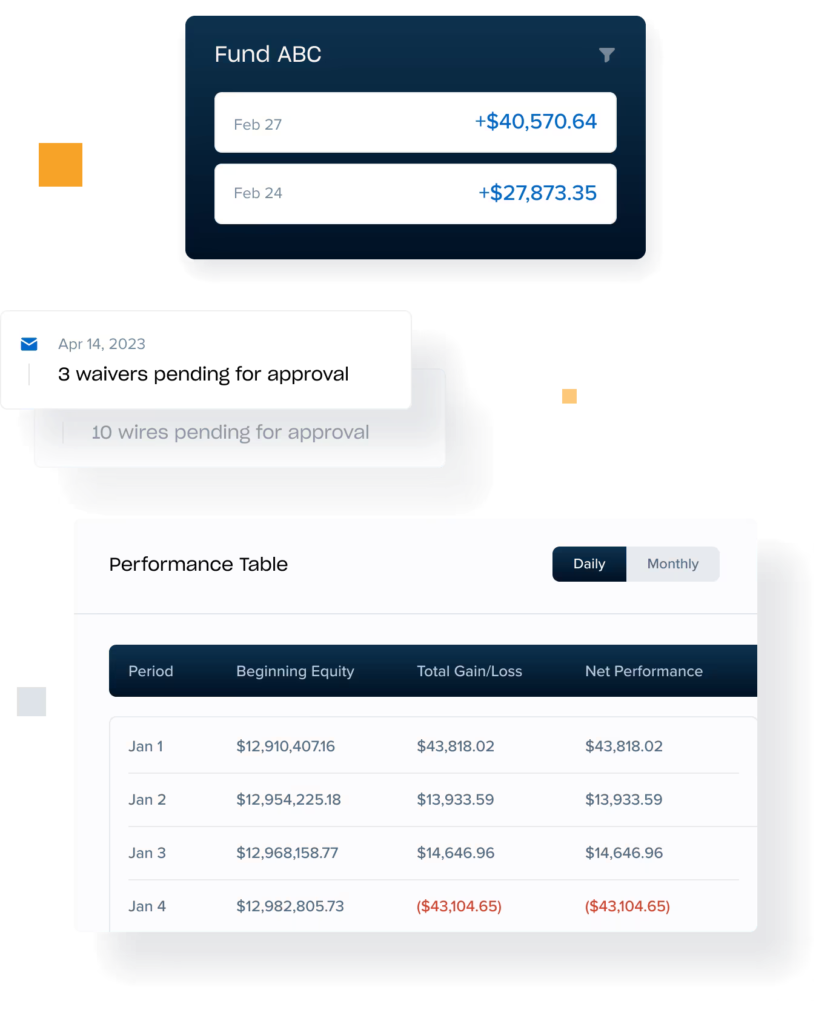

At Heisler Capital, our approach is guided by two core principles: volatility and value investing. We embrace market fluctuations as opportunities rather than obstacles, leveraging them to generate returns for our members. Simultaneously, we adhere to the timeless strategy of value investing, seeking out undervalued assets with the potential for long-term growth.

Our commitment extends beyond profit generation; we prioritize the preservation of our members’ returns. Through meticulous risk management and strategic diversification, we aim to safeguard your assets while maximizing potential gains.

By focusing on high quality companies at deep value relative to the market, we seek to offer our members exceptional returns.

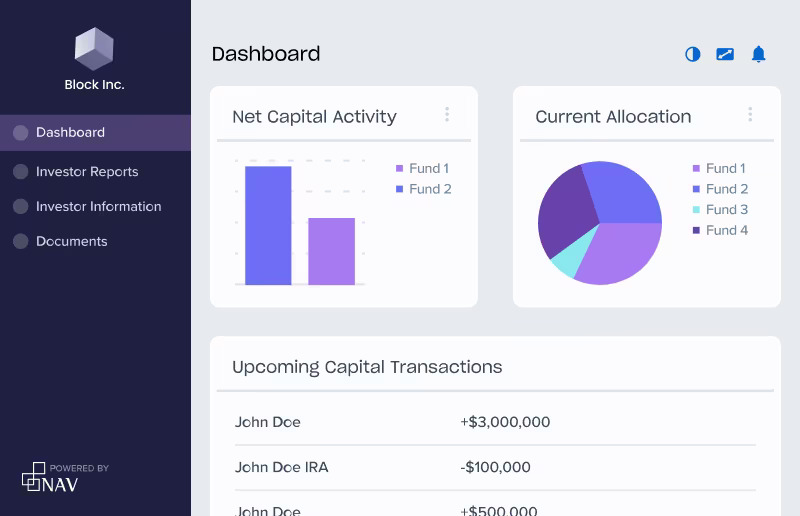

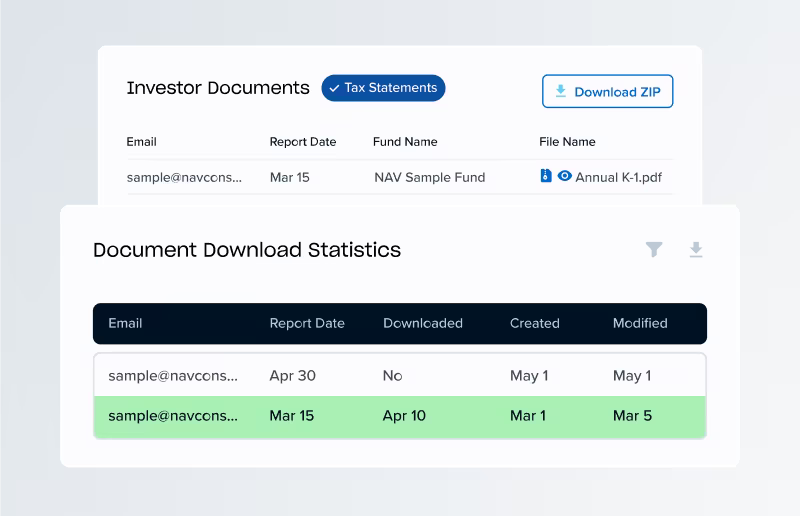

Founded in 1991, NAV is a privately owned fund administrator recognized for its innovative solutions and high-touch client support.

A dynamic team of more than 2,750 professionals provide services to 2,300+ clients across the globe. NAV has achieved more than 30 years of year-over-year growth and maintains a remarkable 99% client retention rate, servicing more than $310 billion AUA.

Managing Partner

Entrepreneur with 30 years of investing experience. Value Investing & Long term capital appreciation

Managing Partner

Technical analysis trader, focused on daily operations and risk assessment. Background on genetics research.

Heisler Capital offers an investment vehicle with no time horizon. We want to create a space for members to invest their assets and feel assured in their safety.

© 2024 Steep Fund. All Rights Reserved.